|

Wireless CommunicationChapter: Business and Regulatory Aspects |

It appeared desirable to assign a fee for spectrum occupancy, to encourage fairer and more efficient use of scarce resources. Evidently this fee should reflect the economic interest in spectrum resources and must be in line with income that operators can generate from their services.

Expected coverage of cellular telephone systems by the year 2000.

|

(Expected) number of subscribers worldwide. |

In September 1997, there were some 137 Million subscribers worldwide. This number is expected to grow to 600 Million

in the next five years.

In September 1997, there were some 137 Million subscribers worldwide. This number is expected to grow to 600 Million

in the next five years.

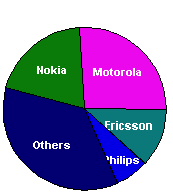

Motorola (26 percent), Nokia (20 percent) and Ericsson (12 percent) dominate the market for cell phones. According to financial experts at most three manufacturers of cell phones can be economically viable, and achieve the necessary volume to follow the price erosion of 20% a year. Recently, Philips (7 percent market share in 1997) and Sony aggressively entered into the market.

The infrastructure is mostly supplied by Ericsson (30%) and Motorola (20%). Nokia has a 6.2 % market share.

In 1982 the FCC set up rules for cellular markets, and divided

the U.S. into 734 territories.

Up to two operators can provide cellular telephony in each market.

Competition was to bring prices down.

In 1982 the FCC set up rules for cellular markets, and divided

the U.S. into 734 territories.

Up to two operators can provide cellular telephony in each market.

Competition was to bring prices down.

In 1992, the cellular operators had 10 Million subscribers, with the revenues of about 7 Billion USD. Rates were 25 to 90 USD cents per minute, but economists claimed that they saw no intrinsic reason why calls couldn't be priced at 10 to 15 USD cents per minute.

End 1994, the number of mobile phone users in the U.S. was about 24 Million. See the curve showing the number of U.S. subscribers.

The projected number of wireless data users in the year 2000 is slightly less than 10 Million. 26% of the users of PCS networks are expected to be use wireless data services.

In 1995, 31 Million people used pagers.

|

Possible negative operator cash flow if

the life cycle of cellular standards are too short.

If a new system has to be introduced before the old system is earning back its investments. to cumulated cash flow may continue to grow negative. In order to interest potential customers in the new system, its radio coverage, the number of base stations, and the grade of service, e.g. the blocking probability or lost call rate, have to outperform the previous system. Hence, so the required investments increases with every generation of the cellular system.

Start page of video from Short Course by BMRC Video from Wireless Communications Networks Short CourseInitially you have to do significant investments in buying lots for base stations, setting up base stations, interconnecting all these... So you start with a negative cash flow but you expect that once the system is operational that you gain a lot of money.. ... ."

|  Embedded QuickTime Video | |

In May 1997, several years after start of operations, the German GSM operator Mannesmann had 5,500 base stations running. For a newcomer, to make this investment at once without having revenues from subscribers would be a large financial risk. However, starting with a smaller network, with less coverage would be unattractive for subscribers.

The second GSM operator Libertel estimates that their GSM network, when fully

operational with 730 base stations will have required an investment of about 400 Million USD.

Investment figures of a few Billion USD have been mentioned

by potential operators for a DCS 1800

covering The Netherlands entirely.

The accumulated losses of Libertel amounted to nearly 200 Million

USD by the end of 1996, after being operational since October 1995.

Not only investments in the infrastructure, but also

the bonuses and rebates to customers contributed to this. Free handsets to 1.3 Million subscribers required a market investment of 200 Million USD.

The second GSM operator Libertel estimates that their GSM network, when fully

operational with 730 base stations will have required an investment of about 400 Million USD.

Investment figures of a few Billion USD have been mentioned

by potential operators for a DCS 1800

covering The Netherlands entirely.

The accumulated losses of Libertel amounted to nearly 200 Million

USD by the end of 1996, after being operational since October 1995.

Not only investments in the infrastructure, but also

the bonuses and rebates to customers contributed to this. Free handsets to 1.3 Million subscribers required a market investment of 200 Million USD.

The 1995 estimated cost of a GSM type handheld mobile phone is approximately 100 USD. The battery, antenna, chip set, printed circuit board, etc cost about 40 USD. The embedded software, and royalties for its patents amount to about 60 USD.

Dealers asked about 300 USD for a GSM phone in 1996, while around 1989 they price was still about 5,000 USD, but with substantial differences among the different countries. Price erosion of the handset is on the order of 20 to 25% per year. Currently, many network operators provide phones for prices below their cost price. Offers range from 1 USD to about 150 USD, if the customer signs up for the service for a certain minimum period of time. If the phane is offered for free, such market investment is recovered in about one year and half.

In Holland, monthly cellular subscription rates differ from 15 to 70 USD. National calls costs range from 0.15 USD in the weekends to 1.50 USD per minute during peak time. Typically, calls during peak time cost about 0.40 USD per minute.

Rates in the Nordic Countries, where cellular telephony is widespread for already for a much longer period of time, rates are about half of those in Holland.

The typical cash flow model is based on a business

model in which handsets are given almost for free to customers

signing up for a certain minimum subscription period: Some 1997 figures:

|

Network operators provide a bonus of 175 USD on each cell phone sold. The service providers offer an additional bonus

of 75 USD.

Dealers obtain handsets at approximately 225 USD, so their earn a 25 USD margin for new subscriber. Monthly subscription plus calling bills are approximately 50 USD per subscriber. The operator receives 75 to 80%, leaving 20 to 25% to the service provider. Typically it takes the service provider about one and half year to recover the investment of each free handset. |

Literature

on Pricing

Literature

on Pricing